Swoosh Finance brokers will help fulfil your dreams by utilizing the equity on your existing mortgage. Enquire today and our friendly team will get back to you shortly with affordable options. We have relationships with the nation’s best lenders, meaning we can find the best deal to suit your needs, without the hassle of multiple applications.

About Home Equity Loans

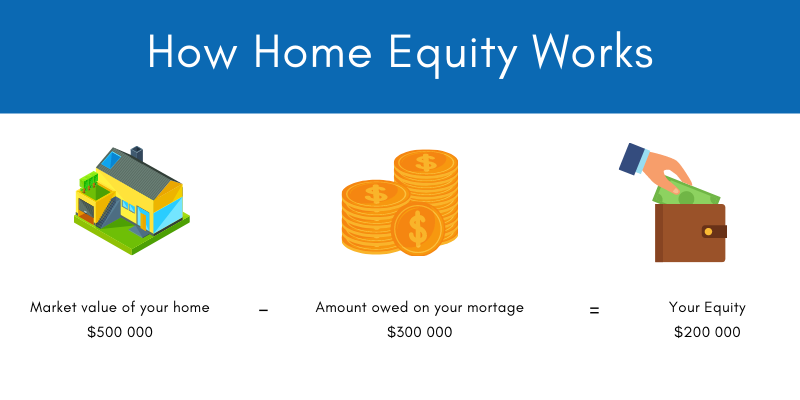

A home equity loan, otherwise known as a caveat mortgage, or second mortgage, is an amount borrowed against the equity in your mortgage. Your Home Equity is derived from the market value of your property compared to what is owed on the property. (market value less the balance of your mortgage)

You can use this equity on your mortgage to renovate your existing property, buy an investment property or any other lifestyle goals. Many people use their home equity to add value to their property through renovations or other assets such as solar power. You can also use it to purchase other assets such as a motorhome.

To learn more about Home Equity Loans, read our comprehensive guide.

How It Works

Our Home Equity Loans are done a little differently. Once you have applied online, our brokers review your application within 60 minutes. Then they compare lenders and match you with the best loan for your circumstances. This means you can get the best loan for you, often cheaper than the bank! Enquire today and find out how we can help you get on the road.

Find out more: rates and terms

Eligibility for our Home Equity Loans

You can apply for a home equity loan through Swoosh if you meet these criteria:

- Be 22 years or older (a guarantor is required if under this age)

- Have been employed for at least 3 months

- Be a New Zealand permanent resident or valid visa holder

- Own a car or vehicle registered in your name (security for the loan)

- Earning a minimum of $400/week